Connecticut is an excellent place to start a business. But, like all US states, it has some specific laws and regulations you need to follow to legally conduct business there.

In this guide, we’ll walk you through the 17 steps needed to start a business in Connecticut, including how to:

- Develop your business idea and research its potential,

- Choose your business entity,

- Name your business,

- Acquire the necessary licenses and permits,

- Register your business,

- Get your federal and state tax IDs and pay taxes, and much more.

At the end of the guide, you’ll also find:

- Expert tips from a prominent Connecticut tax attorney, Eric Green, and an award-winning Connecticut entrepreneur, Kellie Burke,

- Answers to some of the most frequently asked questions on the topic of opening a business in Connecticut, and

- Valuable resources for further research.

Is Connecticut a good state to start a business? Key takeaways

Connecticut is a fertile land for entrepreneurs, with several large metropolitan areas, such as Hartford, Stamford, Norfolk, and New Haven. According to U.S. News, Connecticut also is one of the 10 most educated states in America, with almost 50% of college-educated people.

So, it’s no wonder some of the main industries in Connecticut include:

- Aerospace manufacturing and shipbuilding,

- Film, television, and digital media,

- Financial and insurance services,

- Bioscience and healthcare,

- Tech innovation,

- Green energy, and

- Insurance.

So, your next step is to do market research and figure out what businesses are in line with your skills and have the greatest chance of success.

When it comes to the cost of living in Connecticut, the state is among the more expensive ones, ranking 44th in the US, according to the Missouri Economic Research and Information Center.

The scores are measured against the national average (100.0) — all scores above 100.0 signify a higher-than-average cost of living.

| Connecticut’s Cost of living score and USA ranking* | ||

|---|---|---|

| Cost of living index | 116.8 | 44th |

| Groceries | 103.0 | 33rd |

| Housing | 125.5 | 42nd |

| Utilities | 130.3 | 50th |

| Transportation | 109.8 | 40th |

| Health | 104.8 | 40th |

| Miscellaneous | 115.8 | 46th |

| *Scores above 100.0 indicate cost above the average | ||

When it comes to taxes in Connecticut, the Tax Foundation places it in 47th place, with an overall tax score of 4.08 out of 10.0.

The table below shows how Connecticut ranks compared to other US states in various tax categories.

| Connecticut’s tax score and USA ranking* | ||

|---|---|---|

| Individual taxes | 3.41 | 47th |

| Corporate taxes | 5.09 | 27th |

| Sales taxes | 4.80 | 23rd |

| Property taxes | 2.27 | 50th |

| Unemployment insurance taxes | 5.07 | 23rd |

| Overall | 4.08 | 47th |

| *Higher scores are better | ||

Unsure about whether to start a business in the US? Maybe the following statistics on small businesses will help you make up your mind:

How to start a business in Connecticut in 17 steps

If you’ve decided that Connecticut is the right place for your business, the next step is to familiarize yourself with all the rules, regulations, and best practices of starting a business before moving on to the practical steps.

In this section, we dive deep into the 17 steps needed to start your business in Connecticut. We advise you to read through them carefully, but make sure to consult with a professional before making any important decisions.

Step #1: Develop your business idea in detail

All good things start with a mind-tickling idea. Most of you looking to start a business already have one of those — that’s why you’re here — to find out how to make it real. The first step is to develop that idea.

Here are a few questions Inc. Magazine suggests you ask yourself to check whether your business idea will work:

- Does your business idea fit with what you can and like to do?

- How is your competition faring, and what can you do to improve your offer?

- Is there a stable demand for your product or service?

- Would people be willing to pay for what you’re offering?

- How marketable is your idea?

If your answers to these questions are all favorable, you’re probably good to go — if not, consider how you can make your business idea stand out in an oversaturated market.

An example of how to make your business stand out

Say you want to open a bakery in Connecticut. There may be hundreds of bakeries in your city, so how can you make people choose yours over others’?

There are several things you can do to make your business stand out according to Harvard Business School Online:

- Develop a unique menu — perhaps you can offer interesting baked goods from different countries, focus on sweets, sell only whole-grain goods, create a unique vegan menu, offer frozen pastries, offer cooked meals or fast food in addition to baked goods, instead of making human food, open a dog bakery, etc.

- Create a unique environment — create a sitting area, add a playground, create an open concept where customers can see the baking process, etc.

- Improve cost — one of the ways to stand out is to offer a popular product for a lower price.

- Offer good customer experience — try taking phone/online orders, offer a delivery service, offer a complimentary cookie/juice/coupon for certain orders, many people like to have coffee with their sweet pastries, so have a few types of coffee available in your bakery, etc.

- Pay attention to the location — location is key for most businesses. In some cases, a business doesn’t have to be unique, it only has to be in a good spot. A normal bakery close to a school or in a high-traffic area will likely be successful so long as its baked goods are tasty.

That said, there are probably plenty of entrepreneurs or serial entrepreneurs out there who are itching to start a new business in Connecticut but don’t know where to start.

In those cases, the first thing to do is research the area where you would like to open your business — its most lucrative industries, most successful businesses, most populated cities, etc.

Step #2: Research the business value potential of your idea

Once you’ve decided on the business you want to start or picked a few interesting options, it’s time to do some research and find out whether they have market potential.

The best way to do this is to learn from others — perform market research and competitive analysis.

Performing market research and analyzing your competitors will help you understand:

- Who your competitors are and whether there’s an opportunity window you can use to enter the market,

- Who your ideal customers are and how you can attract a piece of that ideal customer base toward your business (in our case, the bakery) and away from your competitors,

- Better understand the opportunities and limitations of your business, and

- Avoid mistakes your customers have made while copying and improving their successful strategies.

A market and competition analysis may show you negative results — you may realize that:

- Competition is too stiff,

- Market in the area is oversaturated,

- There isn’t enough demand for your product, or

- There aren’t enough qualified people to hire.

If this is the case, your best choice is to move on to another idea or find a different location.

Step #3: Choose your legal business entity

One of the first things you’ll have to do when opening a new business is decide on the type of business entity you want to start:

- Sole proprietorship,

- Partnership,

- Limited liability company (LLC),

- Corporation, or

- Nonprofit organization.

Each of these business entities comes with its own set of advantages and disadvantages, so carefully read through the next section. For more information on federal business taxes, visit the Internal Revenue Service (IRS) website.

Before making any final decisions, we strongly suggest that you consult an attorney, tax advisor, CPA, or another type of professional.

Business entity type #1: Sole proprietorship

A sole proprietorship is a business owned by 1 person. It is not a legal entity, meaning that there is no legal distinction between the owner and the business, and the owner does not enjoy personal liability protection.

That said, this is still the most common type of business in the US because:

- It’s cheap and easy to form,

- The owner has 100% control over the business, and

- The owner keeps all the profits after taxes.

In Connecticut, sole proprietors pay their business taxes along with their income taxes, using the CT-1040 form.

Sole proprietors may need to pay estimated income taxes if they expect to owe more than $1,000 in annual income taxes to the state of Connecticut. To file estimated income taxes, use the form CT-1040ES.

Business entity type #2: Partnership

According to the Connecticut Getting Started in Business guide, a partnership is a type of business where 2 or more people or entities work together on the same business, sharing the same income and losses.

If a married couple is in business together in Connecticut, their business may be treated as a partnership for federal tax purposes if they work together and share the same income and losses. If 1 of the spouses is an employee, the business may be treated as a sole proprietorship.

Limited liability partnerships (LLPs), limited partnerships (LPs), and limited liability companies (LLCs) treated as partnerships are subject to business entity tax in Connecticut.

Business entity type #3: Limited liability company (LLC)

The abovementioned Getting Started in Business guide by the Connecticut DRS states that an LLC may have 1 or more members and is considered a legal entity separate from its members in most cases.

An LLC is treated equally for federal and Connecticut state tax purposes, which means that an LLC may be treated as a sole proprietorship, a partnership, a C corporation, or an S corporation. To check what category your business belongs to, visit the LLC Classification section on the IRS website.

When it comes to Single Member Limited Liability Companies (SMLLCs), they are still considered separate legal entities for employment tax purposes and certain excise tax purposes even when they’re effectively treated as a sole proprietorship for federal tax purposes.

Business entity type #4: Corporation

DRSs Getting Started in Business guide describes a corporation as a legal entity separate from its shareholders. There are 2 main types of corporations:

- C-corporation — all corporations are considered C-corporations by default. C-corporations have no restrictions on the number of shareholders they can have, find it easier to raise money, and have a lower minimum tax rate. However, C-corporations are subject to double taxation. In Connecticut, C-corporations pay for the privilege of operating in the state and have to file the REG-1 form to register for business taxes.

- S-corporation — passes its income, losses, deductions, and credit through its shareholders who file taxes on their personal income tax returns. In this way, S-corporations avoid double taxation. In return, S-corporations have certain limitations. To become an S-corporation, a corporation must file form 2553, Election by a Small Business Corporation. Every Connecticut S-corporation is subject to business entity tax, but not the corporation business tax, since they are treated as pass-through entities (PE).

Business entity type #5: Nonprofit organization

A nonprofit organization operates for a purpose other than collecting profit — religious, educational, scientific, charitable, etc.

Nonprofits can be formed as:

- Corporations,

- Partnerships,

- Foundations,

- Unincorporated associations, or

- Condominiums.

All of the abovementioned nonprofit types may apply for tax exempt status with the IRS.

In Connecticut, nonprofit charitable organizations must register with the Department of Consumer Protection Charities Unit which keeps a registry of all charitable organizations.

If you’re planning to start a nonprofit, consider taking advantage of a free digital management tool that can help you organize your tasks and projects.

Step #4: Name your Connecticut business

After you’ve chosen a structure, it’s time to pick a memorable business name. It’s important to choose a business structure first because how you name and register your business in Connecticut will depend on it.

Business name for sole proprietorships and partnerships

If your business is a sole proprietorship or a partnership, you don’t have to register your business name.

Sole proprietorships automatically take on the full name of the business owner (e.g. Sophia Pearson). On the other hand, partnerships are named by combining the surnames/entity names of 2 or more partners (e.g. Johnson & Johnson, Uber & Spotify).

If your business is a partnership or a sole proprietorship and you wish to use a name other than your personal name, you must file for a DBA (doing business as) — or a trade name, as it’s known in Connecticut.

In Connecticut, trade names are filed with your local town clerk. You can find your local town clerk by searching the Connecticut Town Clerks Association Directory.

All entity types may file for a DBA/trade name that’s different from their entity’s legal name.

Business name for LLCs and Corporations

If your business is an LLC or a corporation, there are 2 important factors to consider:

- Connecticut LLC naming rules,

- Connecticut business corporation naming rules, and

- Business name availability.

According to the General Statutes of Connecticut, LLCs and corporations must adhere to the following naming rules:

- The name of an LLC or corporation must contain the words “limited liability company” and “Incorporated” or any of their abbreviated versions.

- The name of an LLC must not contain words that suggest the company is performing any type of activities related to the Connecticut bank (e.g. bank, loan, trust bank, etc.) as described in section 36a-2 of the Connecticut Statutes.

- The name of an LLC or corporation must not correspond to any other name currently in use and registered with the Connecticut Secretary of the State.

- The name of an LLC must not correspond to any name currently reserved with the Connecticut Secretary of the State.

- The name of a corporation must not contain words that suggest that the company is doing business other than permitted by section 33-645 of the Connecticut Statutes or described in its certificate of incorporation.

For more detailed information, including workarounds and exceptions to the rules, check the full LLC and corporation naming rules linked at the beginning of this section.

To check if the name you’re thinking of using is already registered in Connecticut, search business records using the Connecticut Business Search.

To check if the name you want to use is trademarked, check the US Trademark Electronic Search (TESS).

Step #5: Reserve or register your business name in Connecticut

Once you’ve chosen your ideal business name, you can either:

- Reserve your business name, or

- Register your business name right away.

Option #1: Reserve your business name

You may choose to reserve your business name if you don’t plan on starting a business right away but want to make sure no one uses it in the meantime.

To reserve your business name, file the Application for Reservation of Name with the Connecticut Secretary of the State. Reserving the name costs $60, and it will keep your name safe for 120 days, starting with the day of filing the application.

Option #2: Register your business name

There is no need to register your business name in Connecticut. Once you have registered your business, the name will also be registered automatically.

To find out how to register your business, read the Register your business section of this guide.

Step #6: Get the necessary licenses and permits

Connecticut doesn’t require businesses to obtain a general business license. Instead, there are a slew of other permits and business-specific licenses necessary to operate a business in Connecticut.

Here are the types of business licenses and permits you will need to get in Connecticut:

- Occupational/professional business licenses — the Connecticut Department of Consumer Protection offers an extensive list of industry-specific licenses. Find the one you need and apply online, directly through the website.

- Federal business licenses — depending on your occupation, you might need to acquire certain federal licenses. To find out if you need one, check with the US Small Business Administration.

- Local business licenses — depending on your local town laws, you might be required to obtain a local business license. To find out if you need one, check your town’s official website or public library.

- Sales and use tax permit — if you’re renting, leasing, or selling goods or taxable services, or operating any type of lodging establishment, you’re required to get a sales tax and use permit from the Department of Revenue Services (DRS). For more information on the sales and use tax permit, refer to the tax section of this guide.

If you’re having trouble finding the license, permit, or certification you need, there’s an option to look them up using the Connecticut Economic Research Center (CERC) license search. Otherwise, you may consult the Connecticut Statutes licensing directory.

Step #7: Register your business in Connecticut

To register your business in Connecticut, the Connecticut official state website lists that you need the following information:

- Business name,

- Business location,

- Business email address,

- NAICS code, and

- Name of your registered agent.

Depending on the type of business you want to register, you’ll need some additional documentation we’ll go over in the following section.

But first, let’s briefly explain how to get a NAICS code and a registered agent.

Determine your NAICS code

A NAICS code is a 6-digit number that denotes the type of business you’ll be operating.

You can find out what your NAICS code is for free by reading through the latest NAICS reference files, consulting the NAICS Manual, or searching the US Census Bureau NAICS directory.

If you’re having trouble figuring out which code to use, you can search the Connecticut official website’s directory directly on the business registration page — the system will provide you with the correct number.

Alternatively, you can try out the new Connecticut business checklist tool for starting a business where you can play with creating different fictitious businesses, finding your correct NAICS code, and more.

Designate a registered/business agent

A registered agent, a business agent, or a statutory agent, as they’re known in Connecticut, is a person or entity that you can authorize to receive your official legal mail.

Every business recognized as a legal entity in Connecticut (corporation, LLC, LP, LLP, nonprofit. etc.) is required to have a registered agent.

Your registered agent in Connecticut can be an individual, an entity, or a service that charges an annual fee.

If your designated registered agent is an individual, they must:

- Be trustworthy,

- Be over 18 years of age,

- Be available during normal business hours to receive and forward your mail, and

- Have a permanent address in Connecticut.

In Connecticut, you can be your own registered agent if you’re a permanent resident of the state. Entities cannot be their own registered agent.

Otherwise, there are multiple registered agent services in Connecticut that you can employ.

To register an agent as an unincorporated association, file the Appointment of Statutory Agent for Service with the Connecticut Secretary of the State.

How to register a sole proprietorship in Connecticut

“Registering” a sole proprietorship in Connecticut is easy. There’s no specific certificate you need to obtain or a form you’re required to file to register.

All you really need to do is get an occupational license or permit (if your business needs one) — most likely, you’ll need a sales and use tax permit, plus any other business-specific professional licenses and permits or town-specific licenses.

Technically, you don’t need to get a trade name (DBA), you don’t need to open a separate business bank account, and you don’t need an EIN either unless you plan on hiring employees. However, it’s recommended that you get all 3 of these things for several reasons:

- Filing for a trade name (DBA) will help with your business branding and allow you to protect your personal information to an extent by using your trade name instead of your full name and surname on public records.

- Opening a business bank account will allow you to separate your business and personal funds.

- Getting an EIN will allow you to hire employees and protect your personal information to an extent since you won’t need to write your social security number on every business-related document — you’ll use your EIN instead. Additionally, some banks may require you to have an EIN if you want to get a business loan.

How to register a partnership in Connecticut

According to the Connecticut General Statutes, section 34-314, “…the association of two or more persons to carry on as co-owners a business for profit forms a partnership, whether or not the persons intend to form a partnership.… A person who receives a share of the profits of a business is presumed to be a partner in the business”

Similar to sole proprietorships, there’s no official form you need to file with the Secretary of the State to form a partnership in Connecticut.

What you need to form a partnership in Connecticut is:

- An Employer Identification Number (EIN) so that you may pay your taxes, and

- The REG-1 form to register your business for tax purposes.

Just like with a sole proprietorship, you may choose to keep the partners’ surnames as your business name, or you may file for a trade name (DBA).

The Connecticut General Statutes, section 34-324 states that partners may file a Statement of Partnership Authority where partners can determine the level of authority of each partner, as well as name a registered agent if they want to.

A partnership agreement is another optional document in a partnership. A partnership agreement is an agreement made between 2 or more partners that serves to manage the relationship between them. There is no need to file this document with the state.

Those wanting to start a limited partnership in Connecticut must file a Certificate of Limited Partnership with the Secretary of the State. The Certificate must be signed by all general partners.

How to register an LLC in Connecticut

If you want to register an LLC in Connecticut, you’ll need to file the Certificate of Organization with the Secretary of the State. According to the Connecticut General Statutes, section 34-247, an LLC is considered formed the moment this document is filed. The filing fee is $120.

Apart from the Certificate of Organization, you’ll also need a registered agent and a NAICS code specific to your business.

How to register a corporation in Connecticut

To register a corporation in Connecticut, you’ll need the following:

- An appointed registered agent,

- A NAICS code,

- A Certificate of Incorporation for stock corporations filed with the Secretary of the State — $250

- A Certificate of Incorporation for nonstock corporations filed with the Secretary of the State — $50

- An Organization and First Report (otherwise known as the initial report) filed with the Secretary of the State within 90 days of filing the Certificate of Incorporation — $150.

Additionally, as per the Connecticut General Statutes, section 33-640, “the incorporators or board of directors of a corporation shall adopt initial bylaws for the corporation.”

How to register a nonprofit in Connecticut

A nonprofit organization is considered a nonstock corporation. Therefore, nonprofits follow the same registration rules as corporations.

Same as with for-profit corporations, a nonprofit will have to file the same Organization and First Report ($50) linked in the previous section within 90 days of filing the Certificate of Incorporation.

Besides these 2 vital documents, you’ll also need an appointed registered agent and a NAICS code, as well as the initial bylaws to regulate your organization’s internal affairs.

Nonprofits may be exempt from paying federal taxes. To learn more about tax exempt status and whether your organization is eligible for filing, check the official information on the IRS website.

If you find that you are eligible, you can file for tax exempt status directly with the IRS. Remember to do this before you file the Certificate of Incorporation.

Step #8: Obtain federal and state tax IDs

Except for nonprofit organizations eligible for tax exempt status, all businesses in the US must file both federal and state taxes regularly if they’re to function legally.

Get your Employer Identification Number (EIN)

The Employer Identification Number (EIN) is your unique federal ID. The EIN is issued by the IRS for free. If you apply for an EIN online, you’ll receive your number immediately.

Having an EIN is necessary if you are to file taxes, receive loans, or hire employees. All business entities save for sole proprietorships must have an EIN to operate.

Get your Connecticut registration number

Certain states in the US require businesses to have state IDs in addition to their EINs — Connecticut is one of them.

To apply for a Connecticut registration number, visit the Connecticut Department of Revenue Services (DRS) MyconneCT on their official website and click on the New Business/Need a CT Registration Number link in the Business category.

Step #9: File for state taxes in Connecticut

After obtaining your Connecticut registration number, you will need to register your business for tax purposes.

Sales and use tax

Most likely, you will need to register for sales and use taxes. As per the Department of Revenue Services, the sales and use tax permit is necessary for businesses that:

- Lease, rent, or sell goods or services,

- Operate a hotel, motel, or another type of lodging business, or

- Sell taxable services in Connecticut.

To obtain the sales and use tax permit, you need to file the REG-1 form (Business Taxes Registration Application) for each of your business locations. The permit costs $100 and is valid for 2 years.

Some businesses are exempt from the sales and use tax. To see if you qualify for the sales and use tax exemption status, check the Connecticut DRS official website.

Obtaining a sales and use tax permit is mandatory in Connecticut. Those who operate a business that requires a sales and use tax permit without obtaining it will face monetary penalties or imprisonment for up to 3 months, or both, according to the Connecticut DRS.

Sales and use taxes are filed using Form OS-114 (Connecticut sales and use tax return). For further information on how to fill out the form, consult the instructions for Connecticut sales and use tax return.

Business use tax

Businesses in Connecticut are required to pay the business use tax (AKA Connecticut use/sales tax) for all taxable goods or services (purchased, rented, or leased) made for their business for which the sales and use tax has not been paid.

Business use tax is mandatory for both the businesses that already pay sales and use tax and those that do not.

The same Reg-1 form used to register for sales and use taxes is also used to register for business use taxes.

To file business use taxes, use Form OS-114BUT (Connecticut business use tax return). For further information about how to fill out the business use tax return, consult the instructions for Connecticut business use tax return.

Withholding tax

All new employers who are just starting a business are required to register for Connecticut tax withholding with the Connecticut Department of Revenue Service (DRS).

Employers must file all withholding forms online, using the appropriate Connecticut withholding tax forms.

Step #10: Choose an appropriate location for your business

Location is an important factor when starting a business. Unless you’re primarily conducting business online or working from home as a sole proprietor, choosing the right location for your business will play a major role in the success of your venture.

When choosing the optimal business location, Forbes suggests you consider the following questions:

- Does your business benefit from being exposed to its target audience (e.g. clothing stores, restaurants, cafes, etc.), or are you more interested in a good office space or a large warehouse?

- How likely are you to find your target customer base at a specific location?

- Where is your competition located?

- Does the region where you plan to open your business offer a wide enough talent pool to fit your needs?

- Are there hidden costs to the specific location you’re considering?

- Does location even matter, or will your business benefit from hiring remote employees?

Luckily, according to U.S. News, Connecticut has one of the best business environments in the US, and an admirable education score, making it an attractive state to start your business in.

Some of the largest metropolitan areas in Connecticut where you might want to consider opening your business include:

- Hartford,

- New Haven,

- Stamford/Norwalk,

- New London/Norwich,

- Bridgeport,

- Danbury, and

- Waterbury.

Bridgeport, Stamford, and Norwalk have even been reported as the most educated cities in the nation according to CTPost — most likely due to the proximity of the celebrated Yale University.

The last thing to pay attention to when choosing a location for your business are zoning laws. According to the Connecticut General Statutes, section 8-2, each town, city, or borough is allowed to regulate its own zoning laws. Therefore, be sure to check the zoning laws of the city where you plan to operate your business.

Step #11: Make a clear business plan

Small businesses often neglect this step since it’s not exactly necessary. However, there are a few good reasons why you should have a business plan according to SBA:

- It helps steer your business in the right direction,

- It’s easy to write if you have a clear picture of what you want your business to be,

- It sets clear milestones and informs future decision-making, and

- It helps you convince banks and investors that your business is worth their money.

Your business plan can be as detailed as you want it to be, or not detailed at all. But, you should use it as an opportunity to loosely plan the next 3–5 years of your business and present it to banks and investors. This means that there are a few sections every business plan should have:

- Executive summary,

- Company description,

- Description of product/service,

- Market analysis,

- Marketing plan,

- Management plan,

- Funding request, and

- Financial projections.

Here, we may return to our bakery business example from before to illustrate what a business plan could look like.

Executive summary

The executive summary may sometimes be the only part of the business plan potential investors will read, which is why it should have a rundown of the most important information from the whole plan.

In the imaginary bakery business plan’s executive summary, you would briefly explain:

- What makes your bakery unique and worth a bank’s/investor’s investment? (e.g. It’s the first pet bakery in town.)

- What kind of products will the bakery be selling?

- Who will own, run, and manage your bakery? You may also highlight your staff’s special qualifications if there are any.

- Where will the bakery be located?

- Include financial information such as the funds and assets you already have, the funds you lack, what they will be used for, and how you plan to repay the money you receive. A brief overview of your plans and projections for the next 3–5 years could also show your dedication and commitment to the business.

Company description

The company description section is where you can go more in-depth about who you are, what made you want to open a bakery, and other relevant details, such as:

- What’s your chosen business format?

- What will be your primary product?

- How is your bakery fulfilling an unfulfilled need on the market?

- Are you starting a new bakery, rebranding, or buying an existing one?

- Where will it be located, and why have you chosen that exact location?

- Who will be your primary clientele?

- Who will work in the bakery?

- What advantages will your bakery have over others?

- When do you plan to open your bakery?

Description of product/service

In this section, you can provide detailed information about the products you’ll be selling in your bakery and potential additional services you plan on offering. Here are some questions you can try to answer:

- Who are your baked goods meant for?

- How will the baking process go?

- How will you deal with leftover food?

- Will you be taking orders?

- What baked goods will you be selling, and how did you decide on that? (e.g. if you’re opening a pet bakery, you’ll need to decide which pets you’ll be selling treats for, what each animal can or can’t eat, what the best kinds of treats are, etc.)

Market analysis

Make sure you perform a thorough market analysis and present your findings in this section. Here’s what your potential investors will want to know:

- What’s the most successful bakery in town?

- What makes it so successful?

- Are there other bakeries around the area where you wish to open yours? If yes, are they successful? Why or why not?

- How can you make your baked goods cheaper/tastier/more accessible/more diverse than that of your competitors?

- How can you improve your service compared to your competitors?

- What’s the main demographic of customers in bakeries?

Marketing plan

This is the part where you describe how you will market your bakery based on your market analysis results.

- How will you let people know about your new bakery?

- What’s your main selling point?

- How will you convert your target audience into paying customers?

- How much money do you intend to set aside for marketing efforts?

- Will you be hiring a marketing manager?

The questions for this section are few, but the decisions you make here will decide if your business will start out with a bang or fail to make an impression.

Here’s a step-by-step guide to help you make an effective marketing plan:

Management plan

In this section, you should describe how your bakery will function. This includes:

- Whom will you employ? What are the requirements?

- If you already have people in mind, highlight their qualifications and strengths.

- Attach resumes of your selected personnel.

- What will your employee hierarchy look like?

- What will be the wages?

- Name your bank, insurance company, accountant, etc.

Funding request

The financial part of the business plan is the one banks and investors will be especially interested in. In the funding request section, you should lay out the following:

- How much money do you need to open your bakery?

- How much money will you need to function for the first year?

- How much money do you already have?

- How much money will you need to acquire?

- How will you acquire the money?

- What will the money be used for?

- How do you plan to repay the debt?

- What will you do if the business fails?

Financial projections

The financial projections section will describe what you expect your business to earn within the next 3–5 years.

If the business is new, convince the reader that you believe in the success of your business. If the business is not new, include income statements, balance sheets, and other financial information on which you will base your projections.

Step #12: Secure the necessary funding for your business

Generally speaking, if you want to start a business, you’ll probably need some funds to get you started. There are several ways to get the money you need:

- Self-funding,

- Business loans,

- Grants,

- Investors, and

- Crowdfunding.

Option #1: Self-funding

The first option you should consider when starting a business is self-funding. You may want to save up or ask friends and family for help if you think this will allow you to secure enough funds to start and fund your business for a while.

Self-funding won’t work for everyone. Before committing to this route, explore the various self-funding strategies suggested by 15 Forbes Finance Council members. They should help you decide whether self-funding is the right choice for you depending on the type of business you want to start and the expansion rate you expect it to have.

Here’s a brief summary of the advice these experts had to give:

- Consider how much control of your business you want to have.

- Consider how fast you want/have the potential to grow.

- Understand the market and your business’s needs and seek investors only if absolutely necessary.

- Beware of the potential impact using credit cards can have on your personal life.

- Consider whether you have enough liquidity to self-finance your business.

- Create a use-of-funds roadmap to determine whether self-financing is feasible.

- Consider seeking investments on top of self-funding.

- If self-funding isn’t an option, consider finding a partner.

Consider the advice listed above and determine whether self-funding is possible for you, and even if it is, whether it’s the right option.

Option #2: Business loans

Another way to fund your business is to take out a bank loan. Luckily, there are several business loan options in Connecticut to help you grow your business, such as the Connecticut Small Business Boost Fund.

Another option is to seek assistance from the US Small Business Administration (SBA) and get one of their SBA small business loans that offer microloans for as little as $500, as well as loans of up to $5,500,000.

If you’re a veteran, there’s also a well-developed Connecticut veteran business support program that offers business incentives, funding opportunities, discounts, and more.

Option #3: Grants

Depending on the type of business you want to start, you may be able to secure a grant.

There are plenty of Connecticut state grants and national grants available for different types of businesses, so check to see if you qualify for any of them.

Some of the Connecticut grants you may apply for are:

- Farm transition grant — a grant for Connecticut farmers wanting to transition to value-added agricultural operations. There are 4 different types of grants within this category: New Farmer Micro Grant, Infrastructure Investment Grant, Research and Development Grant, and Innovation and Diversification Grant.

- Small Business Incubator Grant Program — the Connecticut Center for Advanced Technology offers grants for startups within the Connecticut incubator facilities.

- Rural Energy for America Program — provides loans and grants for rural small businesses and agricultural businesses that want to use renewable energy systems.

Option #4: Investors

If none of the above-mentioned options work, or your startup idea is too ambitious for self-funding or a simple small business loan, you might have to search for investors.

Generally speaking, there are 2 types of investors:

Angel investors are relatively wealthy individuals who tend to invest smaller amounts of money in startups to help them find their footing without trying to control the business. Angel investors typically regularly invest in startups. However, an angel investor can also be a friend or family member.

On the other hand, venture capitalists are typically companies that sponsor a business in the long term and take their fair share of equity in return.

If you’re interested in receiving this type of investment in Connecticut, a simple Google search will yield a number of venture capital firms. However, keep in mind that venture capitalists will need to be persuaded to invest in your business, so make sure to have a detailed business plan on hand.

Option #5: Crowdfunding

And the final option is crowdfunding. Popular websites such as Kickstarter, GoFundMe, Patreon, IndieGoGo, and many others offer a platform for creative and innovative people to pitch their business ideas to the public, who then decide whether they want to back it or not.

There are several fantastic benefits of crowdfunding:

- It’s a great way to test the value of your business idea before you make big investments.

- You can potentially raise tens of thousands of dollars or more without getting into debt or giving away equity.

- Crowdfunders don’t ask for much in return for their investment as their investments are typically not large.

- A successful crowdfunding campaign will have a large number of initial customers who will spread the word about your business.

Student entrepreneurs of Connecticut even have crowdfunding opportunities at UConn.

Step #13: Open business banking and credit accounts

Business owners in Connecticut should consider opening a business bank account. While this is a given for larger business entities, it’s also a good choice for sole proprietors.

A business bank account allows you to keep your personal and business funds separate, and it’s required if you want to receive a loan.

One of the possible accounts you may want to consider is a business checking account. This type of account allows you to write checks in the name of your business. You can also make debit card, wire, and ACH transfers, just like with a personal checking account.

That said, there are a few business checking account benefits:

- Easier quarterly tax payments,

- Credibility with customers,

- Easier accounting, and

- Personal asset protection.

Other types of business bank accounts you may consider include:

- Savings account,

- Credit card account, and

- Merchant services account.

A merchant services account is particularly handy since it allows you to accept debit and credit card payments from your customers.

Another option is to use a small business line of credit to boost your funds in times of need. You may use your business credit or checking account to draw funds from your line of credit.

Step #14: Get the insurance you need

One of the most important things you ought to do when starting a business is get insured.

There are several types of insurance you can get for your business in Connecticut. Some of these are mandatory, some are optional, but all are recommended if you want your business to run smoothly.

Mandatory Connecticut business insurance

If you plan to hire employees, the state of Connecticut requires you to get 3 types of insurance:

- Workers’ compensation — serves to provide medical treatment and compensation to workers who sustain a work-related injury or illness. Employers are required to report all claims of injury to Connecticut DAS. In Connecticut, the state works with a third-party administrator who processes all the claims, stays in contact with the injured employee, helps manage the treatment of the injury, and helps the employee get back to work.

- Unemployment insurance — provides financial assistance to people who have been laid off through no fault of their own. To get the benefits provided by unemployment benefits, Connecticut residents must be unemployed, must have worked in Connecticut for 12 months or longer while earning at least the minimum wage, and must be actively looking for a new job while receiving the benefits.

- Professional liability insurance — according to the Connecticut Department of Public Health, all licensed individuals who provide direct patient care are required to have professional liability insurance in Connecticut. That said, professional liability insurance is a great choice for all businesses as it protects owners and businesses from claims of negligence, misinterpretation, or other mistakes in their product or service. Professional liability insurance is also particularly useful for partners and sole proprietors as they have no liability protection.

Optional Connecticut business insurance

Besides professional liability insurance, which is optional for most businesses in Connecticut, you should also think about getting the following types of insurance:

- General liability insurance — this type of insurance is normally recommended for all types of businesses since it protects owners and their businesses from property damage claims, personal injury claims, reputational harm, advertising mistakes, and copyright infringement.

- Cyber liability insurance — covers the damage that your business may sustain due to a cyber breach, including ransom required for the return of your data, customer and employee lawsuits due to cyber breach claims, lost income due to network outages, regulatory fines, and the cost of restoring your reputation after a data breach.

Step #15: Hire employees

Unless you’re a sole proprietor with a small-scale business, you’ll probably need employees to help you manage the workload. But, hiring employees in Connecticut comes with its own set of rules.

Once you hire an employee in Connecticut, you’ll have to report them to the Connecticut Department of Labor within 20 days of hiring, using Form CT-W4. This goes for:

- Hiring independent contractors,

- Temporary employees,

- People under 18,

- Students,

- Household employees, as well as

- Regular, full-time employees.

Larger companies and third-party agents may report new hires using Secure FTP after receiving permission to do so. In this case, the deadline for reporting a new hire is 14 days after the hiring date.

Every employer should report and pay unemployment insurance taxes in Connecticut. This allows their employees to receive benefits in case they get laid off.

Furthermore, employers must adhere to certain recordkeeping rules. The US Department of Labor has set recordkeeping requirements for US employers whereby they must keep sensitive information for every nonexempt employee. This includes:

- Full name and social security number,

- Address, date of birth, sex, and occupation,

- Hourly pay rate,

- Total weekly earnings,

- Payment dates and covered periods, and much more.

Most employers must also keep accurate occupational injury and illness records, with certain exceptions. To see whether you’re required to keep these records, check the official Occupational Safety and Health Administration (OSHA) website.

To find out more about minimum wage, overtime, sick leave, contract termination, and more, consult the Connecticut Labor Laws Guide.

If you’re struggling to find employees, the Connecticut Department of Labor suggests you contact the American Job Center (AJC), Connecticut branch, to connect with potential hires.

Step #16: Choose the optimal business software

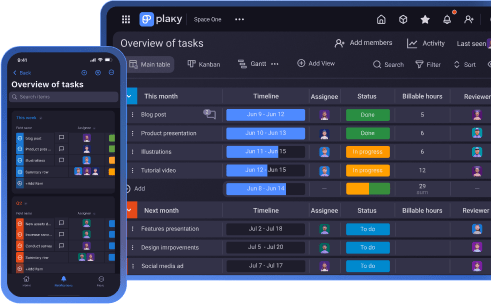

If you want to maximize your chances of success when starting a business, you’ll need advanced organizational skills. But, few people are able to achieve this without any help, which is why most businesses these days use organizational software.

These platforms are so widely used because they allow businesses to keep all their data in one place and share them with all their relevant personnel. It gives business owners and managers a clear overview of their past, current, and upcoming tasks while keeping everyone informed at all times and minimizing the chances of missed project deadlines.

For example, if you were in the process of hiring and onboarding new employees, you could use organizational software to help you keep track of:

- Your list of potential hires,

- The hiring process, and

- The vetting process at a glance.

Furthermore, you could track where your new hire is at in their onboarding process and organize and standardize that process to ensure you don’t forget anything.

Most organizational software platforms make a conscious effort to be user-friendly and flatten their learning curve, so you won’t have to worry about spending days deciphering them.

To further help new users, organizational tools such as Plaky offer a plethora of ready-made templates — such as this employee onboarding template — you can use immediately or edit to suit the specific needs of your team.

There are plenty of digital organizational tools out there, but most are best suited for larger organizations and enterprises, and they can get expensive. So, small business owners may want to minimize their expenses and start out with a free option, such as Plaky.

If you’re interested in seeing more similar platforms suitable for small businesses, take a look at the following article:

Step #17: Build an internet presence

What do you do when you want to buy something, but aren’t sure how much it will cost or don’t know where you can buy it?

What do you do when you’re in a new city and want to find a good place to eat?

Most likely, you Google it.

According to Google Consumer Insights, 53% of shoppers always do research before committing to a purchase. The same research shows that 59% of shoppers claim it’s important for them to be able to shop on their mobile devices.

These statistics suggest that a strikingly large number of people love the convenience of shopping online for various reasons. Not marketing your business to that sea of online shoppers would be a real waste of potential.

So, in this section, we’ll walk you through the process of building your online presence.

Substep #1: Create a Google business account

The Google Consumer Insights research linked in the previous section shows that 85% of shoppers find pictures and business information very important when they’re choosing where to spend their money.

Creating a Google business account allows you to:

- Put out information and images related to your product or service online,

- Receive customers feedback,

- Communicate with customers,

- Display your address, phone number, working hours, and much more.

For example, if you’re running a restaurant, your Google account could display:

- Pictures of the food you’re offering,

- Pictures of your restaurant’s interior/exterior,

- Customer reviews,

- Promotions and discounts,

- Prices,

- Location and contact information, and more.

While having a business website would be great, a Google business account will get you most of the benefits of a website, without the hassle of having to maintain a website. That said, having both would be ideal.

Substep #2: Create a business website

According to Forbes, creating a business website is the most important step when trying to boost your business’s digital footprint. That said, not just any kind of website will do. Your business website should be:

- Professional,

- User-friendly,

- Informative, and

- Helpful.

The great thing about having a business website is that it can also serve as your virtual storefront where your customers can shop or make appointments long after business hours.

As Entrepreneur puts it, having a business website boosts your credibility, extends your reach, and allows smaller businesses to level the playing field and compete with established companies.

Substep #3: Create social media profiles

These days, it’s rare to find a business that doesn’t have any social media presence — rare enough that people can find it strange or even suspicious.

But even if you don’t agree with this statement, there are other reasons businesses need social media profiles.

First of all, being active on social media is equivalent to free advertising. By keeping your social media accounts alive, posting regularly, replying to your customers’ comments and messages, and commenting on other people’s profiles, you expand your reach and create a reputation for your business.

Social media also has options to open business accounts that give you valuable insight into:

- Who your customers are,

- Where they’re from,

- When they look at your posts, and much more.

This information can help you optimize your content for your audience, build trust and loyalty, and further increase your customer base.

The fact that there are many successful businesses that sell their products using only social media tells you just how valuable a tool this can be.

Finding inspiration for regular social media posts can get exhausting, so here are some guidelines on how to build a social media presence along with 60 reusable ideas for your business social media posts:

Free project management software

Create, manage, and execute your business plan using Plaky.

FAQ about starting a business in Connecticut

The following section will tackle some of the most frequently asked questions about how to start a business in Connecticut.

How much does it cost to get a business license in CT?

The cost of business licenses in Connecticut ranges from $20 (apple juice and cider manufacturer) to $5,000 (medical marijuana dispensary facility).

How can a beginner start a business in Connecticut?

The best way a beginner can start a business in Connecticut is to consult an attorney, a Certified Public Accountant (CPA), a tax advisor, and/or another type of professional who is familiar with the laws and regulations of the state.

A beginner entrepreneur would also benefit from talking to other entrepreneurs who have experience in running a business in Connecticut. See if you already know someone who owns a business in Connecticut.

If not, you can see if any local store owners are willing to speak with you, or you can try attending local entrepreneur gatherings.

Another useful resource would be to attend business coaching sessions. There are several institutions in Connecticut that offer mentoring programs and resources to help budding entrepreneurs start their first business, such as:

- Entrepreneurial & Women’s Business Center at the University of Hartford,

- UCONN Entrepreneurship Bootcamp for Veterans,

- Connecticut SBDC, and more.

Does CT require a business license?

In Connecticut, you don’t need a state business license to operate a business. But, you do need a variety of occupational/professional licenses, permits, and town-specific licenses.

The best way to find out whether your business requires one of these licenses is to check the Connecticut official state website for occupational licenses and permits and your town’s official website for state-specific licenses.

What is the easiest business to start in Connecticut?

The easiest and likely also the cheapest business to start in Connecticut is a sole proprietorship business that relies on monetizing your knowledge and skills. This includes businesses such as:

- Tutoring,

- Web content writing,

- Graphic design,

- Handmade arts and crafts, and

- Consulting.

While not necessary, it would make things even easier if you provided your services online. This way, you could run your business from the comfort of your home and not worry about renting an office.

The reason we chose these professions is that they could be run as sole proprietorships, meaning that you wouldn’t have to file expensive paperwork to start your business.

Additionally, these businesses don’t require any occupational licenses or permits, nor do they demand you have employees, making them some of the cheapest and easiest businesses to start in Connecticut.

Tips for starting a business in Connecticut

For this bonus section of our guide, we’ve reached out to 2 established business owners from Connecticut and asked them for professional advice they would give to aspiring entrepreneurs who want to start their business in this US state.

Here’s what they had to say.

Tip #1: Gather enough capital for 1 year

According to Eric Green — serial entrepreneur, established tax attorney, co-founder of Green & Sklarz LLC, and founder of The Tax Rep tax coaching service in Connecticut — one of the main reasons new businesses fail is that they don’t prepare enough capital to keep them afloat until the business stabilizes.

“Make sure you are properly capitalized to carry yourself for a year, not just enough to open the doors. Most businesses fail, and usually, it is because they do not have the capital to carry themselves. For instance, the enterprise doesn’t just have to open, but it needs to be able to pay employees, pay for inventory, advertising, and the owner’s living expenses even when the crowds don’t come bursting through on day 1. You must realize that you will be having to spend whatever comes in the door plus more to just stay afloat while the audience builds. Having enough money/financing lined up to know you can carry for a year without going broke will lay the groundwork for you to ramp up the enterprise and become successful.”

Tip #2: Hire a good accountant

The second thing Eric Green highlights is how important it is to start out with a good accountant on deck.

“It is CRITICAL to have a good accountant in before you open your doors. You must have a handle on your cash and numbers at all times. Sadly, most view accounting as either unnecessary until the tax return is due, or a commodity (I’ll just get QuickBooks and do it myself). A good accountant can provide ideas, help get financing and talk to banks and lenders, and make sure you know where you stand at any given moment.”

Tip #3: Do your market research

The owner of an award-winning interior design firm Kellie Burke Interiors from Connecticut Kellie Burke stresses the importance of understanding yourself, your competition, and the market as a whole. This way, you’ll be able to get ahead of the competition and stand out in the eyes of your customers.

“When starting a business in CT — other than the obvious legalities — I would understand who you are as a brand. Knowledge is power, so do lots of research on your competitors in your industry as well so you can find a new creative way to bring your product to the market that supersedes what is already out there.”

Tip #4: Confirm your facility’s compliance with use requirements

Buildings normally have to comply with certain regulations depending on their intended use. A hospital and a clothing store will have different kinds of requirements when it comes to the layout, ventilation, plumbing, etc.

For this reason, Burke stresses the importance of choosing a facility that won’t require extensive remodeling or a change of use permit to fit its new use (i.e. your business).

“If you’re opening a brick and mortar storefront or office space, definitely take a trip to the town planning office to confirm there will be no unforeseen change of use requirements when moving into a new space or building out an old.”

Tip #5: Don’t forget about marketing

If your product is good, word of mouth will carry your name far. But, before that happens, you need to get your product in front of as many people as possible. This is why Burke advises that new business owners shouldn’t shy away from investing significant portions of their budget into marketing.

“Set aside a minimum of 10% of your overall budget for Marketing to get your name out there.”

Tip #6: Maintain relationships with your local and business community

Business owners, especially those who are just starting out, can find a surprising amount of support in their local and business communities. Kellie Burke recommends joining organizations where you can establish relationships with entrepreneurs like yourself and gain help and insight into the intricacies of running a business.

And if this leads to more opportunities for your business, don’t forget to share your success with others.

“Join your chamber of commerce to establish local relationships in similar small business entities. Give back to your community. “

Connecticut business resources for further reading

Before making any big business decisions you should make sure to conduct thorough research. What follows is a list of official websites you should consult when planning to open a business in Connecticut.

- Connecticut Official State Website — contains most of the official information about forming a business in Connecticut, including the forms for registering your business and acquiring your business licenses and permits.

- Connecticut Department of Revenue — contains all the necessary information regarding Connecticut resident and business taxes, including the forms you’ll need to file those taxes.

- Connecticut Department of Labor — contains all the necessary information for employers and employees, including education opportunities, finding employment/hires, rights, protection against fraud, unemployment benefits, and much more.

- General Statutes of Connecticut — the official Connecticut public acts and regulations, including extensive rules about forming different types of business entities.

- Connecticut Small Business Development Center (SBDC) — a collection of various business resources such as articles, webinars, courses, events, tutorials, and loans for starting a business in Connecticut.

- Internal Revenue Service (IRS) — contains all the necessary information about US federal tax laws and requirements. This is also where you file a request for your EIN.

- University of Connecticut School of Business — business-related education for students, graduates, and veterans alike, including a variety of entrepreneurial educational resources and programs.

- Hartford Entrepreneurial Center — advising, training, networking, and coaching services for budding entrepreneurs in Connecticut.

- Women’s Business Development Council — learning resources and advising services for women entrepreneurs of all levels in Connecticut.

- US Small Business Administration (SBA) — a host of business resources, including extensive information on small business loans.

Starting a business in Connecticut — Conclusion\Disclaimer

We hope this guide was helpful and succeeded in informing you about the most important matters to consider when opening a business in Connecticut.

Keep in mind that this guide was written in Q2 of 2023 and might not contain amendments to the laws and regulations in Connecticut that have been adopted since then.

Please note that we are not authorized to provide legal advice. Therefore, we strongly recommend that you consult the appropriate Connecticut institutions and/or certified professionals, as well as follow the links provided in this guide — most of them will lead you to official websites where you can expand your research — before making any legal decisions.

Plaky is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.